Being a single mom and in debt is stressful and overwhelming especially when you’re not sure who to turn to. It feels like we’re suffocating under the weight of it all and there’s no way out.

I’m here to tell you that there is hope, and I’m going to show you step by step where to start when you want to get out of debt.

Hey, my name is Renee and if you’re like me, it’s hard to talk to friends and family about something as personal as debt. You want to look and feel like you have it all together.

Talking about money feels so vulnerable and you don’t want to be judged by friends and family. Not to mention they may also be very private about their money.

Who Can I turn to?

That’s why I became a financial coach. To help you get out of debt, gain financial independence, build excellent credit, so you can get the BEST opportunities in life!

When I was a single mom living on a low income, I paid off all my debt. I am living proof it can be done and I can help you too. When the timing is right. I’ll share my tips and things I did to make it happen.

It all started with the sleepless nights, tossing & turning wondering how I was going to pay the bills

In addition, I had what felt like a pit in the bottom of my stomach from worrying about how I was going to pay the bills.

Not to mention, being on edge because you are stressed out with no money. I was waiting for my next check to pay for things the children still needed like clothes, shoes or something for school.

Average personal debt

Here are some interesting statistics on personal debt by type in 2021 according to Experian

- Credit card debt: $5,221

- Personal loans: $17,064

- Auto loans: 20,987

- Student loans: $39,487

- Mortgage: $220,380

Image all the interest being paid to these companies each month. Check your statements to see how much you are paying in interest to each company.

Wouldn’t it be nice to keep that money in your pocket? Well, you can!

Step 1

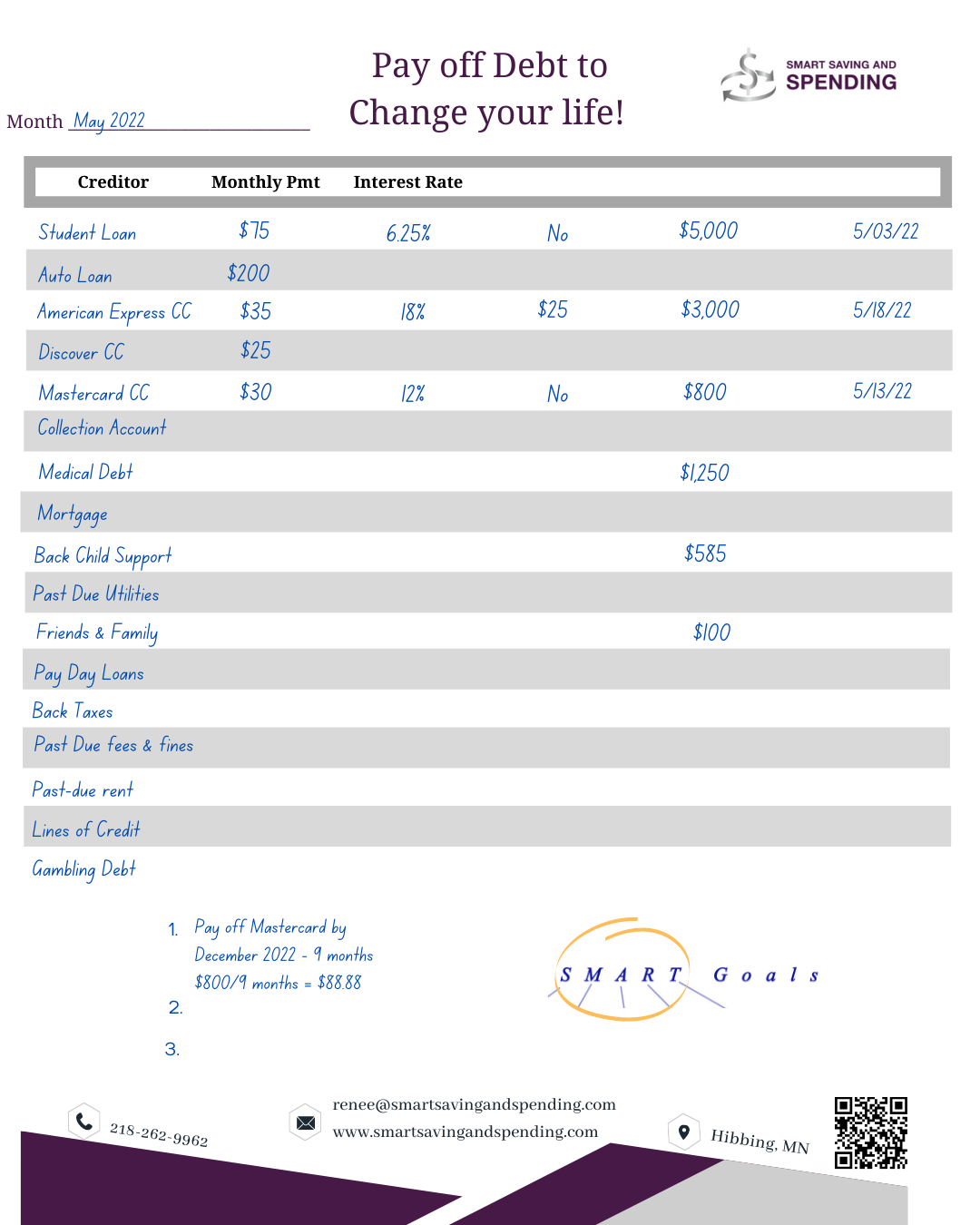

Make a list of all your debts. See picture below for reference.

Step 2.

Next, write down the interest rate for each debt you have.

Step 3.

Then in the next column write down the monthly payment.

Step 4.

After that is complete, write down if there is an annual fee. This will most likely be for credit cards.

Step 5.

Finally, write down the balance you currently owe.

Step 6. Determine what debt you want to pay off first.

There isn’t a right answer or wrong answer. Just your personal preference. Here are some questions to consider.

Writing all this information down will make it very helpful when determining what debt you want to pay first.

Questions to consider

Do you want to pay off the balance with the highest interest rate?

What about the credit card with an annual fee?

Do you prefer to pay off the debt with the lowest balance? If you are like me, this was very motivational!

In consideration of your credit report, would it be better to pay something off that is affecting your credit score?

After writing your down all your debts, you will probably come to a decision as to what is the best for you.

This is a great first step when paying off debt!

Determine what your goal is

Your next step is to determine what your end goal is.

Dalio “Remember that great expectations create great capabilities. If you limit your goals to what you know you can achieve, you are setting the bar way to low.” Ray Dalio

Learn More!

I hope you found this information helpful!

Any recommendations I make should be taken into consideration with your values and goals. You should make the best decision that aligns with your family’s values.

As a Financial Coach, my mission is to help families save more, spend less so they can buy and do the things most important to them and spend their time and energy focusing on their kids.

Spending quality time with your kids is more important than stressing about finances. Instead of going to friends and family and sharing your financial struggles, reach out to me. I love talking about money, values, assessments and strategies to make positive changes to your financial habits to live a life you love.

Stressed About Finances?

I understand because I’ve been through some really challenging financial situations. Learn more about me.

I’m a kind, heart-centered coach who is excited to help you! If you’re struggling with your finances, get the results you want – I promise to keep you accountable and help you manage your finances successfully . I have a 100% guaranteed or your money back for the 1st session!

Finally, I wish you success in your financial journey😊

Join the private Facebook community to get tips, tricks & hacks to save more, spend less & build excellent credit

Follow me on YouTube to get tips, tools and helpful resources to CRUSH your financial goals!

1:1 Coaching:

Get personalized coaching focused on you