If you are like me and love being prepared, You are going to like the 7 questions I have for you!

When I was a single mom, I was a mortgage lender and was still a little anxious about buying a house. I want you to buy your house with confidence. I am here to help you do that.

Did you know that in 2020 single women accounted for 19% of first-time home buyers in the US. (NAR, 2020).

Answering these 7 questions can help you get started when determining if you are ready to buy a house.

Together we will CRUSH your financial goals!

1. Do you have a reliable source of income?

Lenders are typically looking for applicants that have full-time employment and in the same profession or line of work for 2 consecutive years.

If you work part-time hours, you will not qualify. You need to be employed full-time.

2. Do you need to build or rebuild credit?

You absolutely want the best credit score possible!

I think the easiest way to build credit is to make one small purchase each month. For example, buy one gallon of milk and pay for it with your credit card. Then when the statement comes, it’s easy to pay it off.

If you don’t use credit, you won’t build credit.

3. Verify all your information is being reported correctly on your credit report.

Did you know 1 in 5 credit reports have errors? The CFPB has recently put out a statement on medical debt being reported incorrectly. Another industry that has a lot of errors is student loans.

It’s important to make sure everything is correct on your credit report.

To review your FREE credit report, go to Annualcreditreport.com. Get your free report from one of the major credit reporting agencies. The three major credit reporting agencies are Transunion, Experian & Equifax.

You will want to review all your personal information, all negative information and how your payments are being reported.

If you do find an error, you will want to dispute the information being reported. It’s important to write a letter to the credit reporting agency that is reporting it incorrectly along with the company who is reporting the information.

4. Do you have any collection items on your credit report?

If you have collection items on your credit report, it’s really important to make a plan to pay off the debt. Most lenders are going to require you to pay off a collection report prior to extending you a home loan.

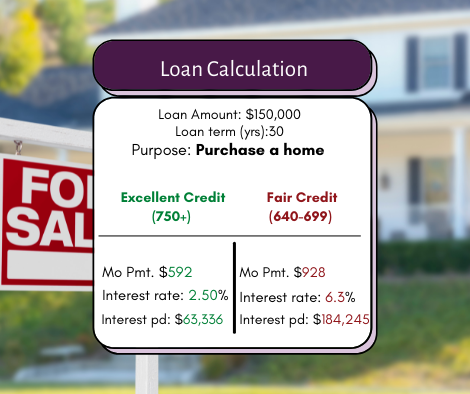

You really want the best credit score possible. Having the best credit score really helps make your monthly mortgage payment the lowest it can be. The higher the risk to lend you money, the more it will cost you in interest. Check out the example below to see how much more it costs you for a fair credit score.

5. Are you able to pay your monthly payments on time?

If you can make all your monthly payments on time, this is a good indication you may be able to afford a house payment. The monthly payments I am referring to are:

- Credit card payments

- Utility payments

- Cellphone payments

- Car

- Student loans

- Rent payment

6. Do you have money saved for a down payment and/or closing costs?

It is really important to save money for a down payment on your house and closing costs.

Did you know that 62% of Americans believe a 20% down payment is necessary to buy a house? I am here to tell you that most mortgage loans require less than 5% down payment? (NAR) National Association of Realtors

To calculate a down payment of 5%, take the amount of you mortgage and multiply it by 5%. This is the amount you need to have for a down payment. For example, $120,000 X 5% = $6,000.00.

There are many programs for first-time homebuyers that include little or no down payment. You will want to discuss this with your lender.

7.Do you have money saved for emergencies, unexpected expenses and home maintenance/repairs?

Unexpected expenses come up all the time in life. It’s better to be prepared because it reduces financial stress.

When you buy a home, there will be maintenance & repairs that will come up.

Did you answer “YES”?

If you answered “yes” to these questions, it is possible you are ready to buy a home. If you answered “no” to these questions, I am here to help you get ready to buy your first home with confidence. Let’s get you the best interest rate possible by building credit today!

It’s totally amazing at what we can accomplish when we don’t give up and continue to take small steps toward a huge goal like buying a house!

Learn More!

I hope you found this information helpful!

Any recommendations I make should be taken into consideration with your values and goals. You should make the best decision that aligns with your family’s values.

As a Financial Coach, my mission is to help families save more, spend less so they can buy and do the things most important to them and spend their time and energy focusing on their kids.

Spending quality time with your kids is more important than stressing about finances. Instead of going to friends and family and sharing your financial struggles, reach out to me. I love talking about money, values, assessments and strategies to make positive changes to your financial habits to live a life you love.

Stressed About Finances?

I understand because I’ve been through some really challenging financial situations. Learn more about me.

I’m a kind, heart-centered coach who is excited to help you! If you’re struggling with your finances, get the results you want – I promise to keep you accountable and help you manage your finances successfully . I have a 100% guaranteed or your money back for the 1st session!

Finally, I wish you success in your financial journey😊

Join the private Facebook community to get tips, tricks & hacks to save more, spend less & build excellent credit

Follow me on YouTube to get tips, tools and helpful resources to CRUSH your financial goals!

1:1 Coaching:

Get personalized coaching focused on you