11 reasons to get out of debt and enjoy your life. When I had a lot of debt, I didn’t enjoy life and I certainly wasn’t at peace. Fast forward to the present and I am now financially happy, secure and at peace.

I did it and you can do it too. Need a coach? Someone to guide you through the process? Get in Touch.

I constantly felt frustrated, stressed and sad. I felt sad because I didn’t want that constant struggle of being limited in what I could do.

We were in so much debt, my stomach hurt and I couldn’t sleep at night! We were even turned down for loans! It was so embarrassing!

We had the latest technology, newer vehicles, a nice home, 4-wheelers, a boat, and a camper. Sad enough, we could not afford a campsite for a weekend. Learn more about me.

Do you have a similar story?

That was my life during my first marriage. A few years later, I became a single mom.

I made the decision, to pay off all my debt so I could have financial freedom. I was tired of living paycheck to paycheck.

My goals is to help you get out of debt and enjoy your life. It’s hard work, but has the biggest reward.

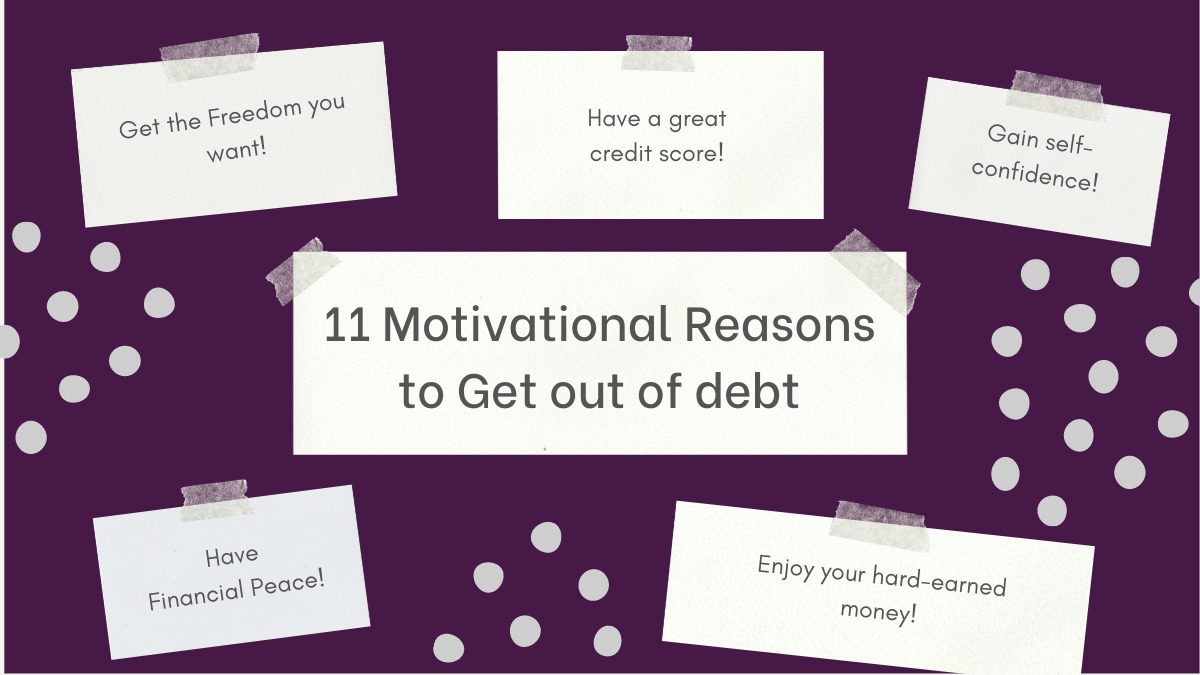

11 Reasons to of Get out of Debt

1. You will have financial freedom

You will have flexibility to make large future purchases and buy:

- Cars

- Boats

- Cabin or vacation home

- Camper

2. You will be relieved from the financial stress and anxiety

Imagine what you can do with the time you spend thinking or stressing about how you are going to pay your credit card bill, unexpected medical expenses, new tires for the car, or home repairs. After all, when you have a plan in place it removes the stress and you can focus on how or where to get it fixed.

Overall, when we feel stressed, our bodies become worn out and tired. When that happens for too long, we can be at increased risk to sicknesses because the immune system is not working like it should. Because we are so tired and have no energy it makes it harder to prepare healthy foods and we end up choosing processed foods that are more expensive. It also makes finding the motivation to exercise much more difficult. This can lead to more medical bills and increased stress levels.

3. Freedom to switch jobs – when you have a passion for your job, you will excel at it, which could potentially lead to promotions.

After paying off most of my debt, I landed a job as a Personal Banker at a Community Bank. I processed and learned in depth about:

- Credit cards – I learned about authorizations, and how much money you pay in interest each month if you don’t pay off the balance.

- Mortgages – The process of purchasing a house and all the details of underwriting a mortgage and HOW MUCH INTEREST you pay each month!

- Loans – I learned how to get the value of new and used cars, trucks, vehicles, motorhomes to produce loan documents and understand them.

- Credit Reports – I learned how to read credit reports and understand them in depth. I learned there are errors on credit reports and how to fix them!

- Traditional & Roth IRA’s – I learned about bank CD’s and IRA’s in depth for retirement. I learned bank CD’s were not as volatile as the stock market and definitely a safe place to keep your money, but does not usually outpace the stock market.

- Checking Accounts – I learned about debit card authorizations, how to avoid overdrafts and avoid ATM fee’s!

- Savings Accounts – I learned about Christmas Club, Vacation and health savings accounts to save for those expensive times in life!

Funny story: I was declined a vehicle loan 7 years prior at the same bank where I was hired as a Personal Banker! Ironically, I was hired for the position of the loan officer who declined our loan! She was retiring!!!

4. You are in control of your money, instead of your money controlling you.

By creating a budget you are in control of your money. You are making the decision to save and spend a certain amount of money each month.

The benefits of a budget include:

- You know how much money you have left after paying your monthly expenses

- Your bills do not shock you (you know they are coming)

- Sometimes you forget about recurring expenses you don’t need/want anymore and they can be cancelled.

- Maybe an expense seems high and now is a great time to start shopping around to see if you can get it at a better price.

- Preparing for large annual expenses like paying for Extracurricular activities.

- Similarly, you understand your monthly income.

- Additionally, you are fully aware of your monthly expenses.

- Furthermore, you know how much money you are saving each month.

If you need more reasons to make a budget, check out 6 Motivational Reasons to create a Budget for you money and why.

5. It alleviates the stress of unexpected expenses

Unexpected expenses are a part of life. They are always going to happen. You can alleviate the stress of unexpected expenses by creating an emergency fund in your budget.

Imagine what you can do with the time you spend thinking or stressing about how you are going to pay your credit card bill, unexpected medical expenses, new tires for the car, or home repairs. After all, when you have a plan in place it removes the stress and you can focus on how or where to get it fixed.

Stress is not good for our mind, body and soul! For this reason, when we feel stressed, our bodies become worn out and tired. For one thing, when that happens for too long, we can be at increased risk to sicknesses. As a result, the immune system is not working like it should.

Under these circumstances, we are tired and have less energy. Therefore making it harder to prepare healthy foods. Thus we end up choosing processed foods or fast food that are more expensive.

Not to mention, having less energy makes it difficult to find the motivation to exercise. Therefore, resulting in more medical bills (along with more expenses) and increased stress levels.

After all, when we eat nutritious foods and exercise regularly, this typically leads to lower medical bills which leads to saving money. This is like happiness on a budget! Imagine what you could do with the money spent on medical bills for something else.

Given these points, it is a very good idea to have an emergency fund for unexpected expenses. For this reason, I recommend $1,000 to start. This is not much money but is a good starting point. In fact, when I did this, it took away the stress of paying for unexpected expenses. Especially when I was determined to start a budget and pay off my debts.

6. You will have a good credit score

Once you get out of debt, you will be making your payments on time. Similarily, you will not have any negative information reporting on your credit report. Making sure all your personal information is reporting correctly on your credit report is very important.

The benefits of a great credit score are:

- You get the best interest rates on personal loans for cars, boats, trucks etc.! (your low interest rate keeps your monthly payment lower. Compared to if you had poor credit, you would pay a higher interest rate)

- In addition, you will get the best interest rate for your mortgage!

- Not to mention, you will always get what you really want to purchase! Never get denied!

- Equally important, you will get the apartment you want to rent!

- Furthermore, you will have lower insurance rates for your home & automobiles!

- Ultimately, you will get the employment you want!!! (Employers can, with your authorization, pull your credit to see how responsible you are with your money)

Now is a great time to start a new financial adventure! Take a risk, become bold and daring! Start a new life by enjoying the simple pleasures in life instead of the most expensive things in life.

7. You will have financial peace in your life, feeling more at ease

Financial peace is really about having a plan for your money. The plan I am referring to is budget. Having a budget for your income, expenses and how much cash you have leftover is having a plan for your money. Having a plan gives you hope, confidence and freedom.

Worrying really does give you something to do, but doesn’t solve your problem. Imagine what you could do with the time you spend worrying?

8. No more sleepless nights

Imagine being at peace and having a sense of calmness to sleep the whole night through. You can have this! I was in debt also and had many sleepless nights.

I was able to pull myself out of debt and I am confident you can too!

9. You will gain self-confidence, self-control that leads to self-satisfaction

I was so pound of myself that I paid down my debts, made a budget and started saving money! Ultimately, it lead me to financial freedom. Ultimately, the freedom to buy a house as a single mom!

10. Stop wondering why you don’t have any money.

Have you ever had the experience of getting half way through the pay period only to find you don’t have much money left? Ugh! I remember when that happened to me. It was so frustrating and angering. Sometimes that is when fun possibilities would come up or an unexpected expense would arise.

This can also be a time when you think you aren’t making enough money. However, if you put together a monthly budget and lived within your means, this doesn’t have to happen to you anymore. I can show you how.

11. Have fun with your hard-earned money

- Vacations

My goal is to help people get out of debt and stop living paycheck to paycheck so they can find financial freedom.

My first step to getting out of debt was creating a budget. Get the budget I created especially for you. It’s your first BIG step to get out of debt.

You can do this too! You can start today by downloading the budget I made. It’s the same budget I use today.

Learn More!

I hope you found this information helpful!

Any recommendations I make should be taken into consideration with your values and goals. You should make the best decision that aligns with your family’s values.

As a Financial Coach, my mission is to help families save more, spend less so they can buy and do the things most important to them and spend their time and energy focusing on their kids.

Spending quality time with your kids is more important than stressing about finances. Instead of going to friends and family and sharing your financial struggles, reach out to me. I love talking about money, values, assessments and strategies to make positive changes to your financial habits to live a life you love.

Stressed About Finances?

I understand because I’ve been through some really challenging financial situations. Learn more about me.

I’m a kind, heart-centered coach who is excited to help you! If you’re struggling with your finances, get the results you want – I promise to keep you accountable and help you manage your finances successfully . I have a 100% guaranteed or your money back for the 1st session!

Finally, I wish you success in your financial journey😊

Join the private Facebook community to get tips, tricks & hacks to save more, spend less & build excellent credit

Follow me on YouTube to get tips, tools and helpful resources to CRUSH your financial goals!

1:1 Coaching:

Get personalized coaching focused on you