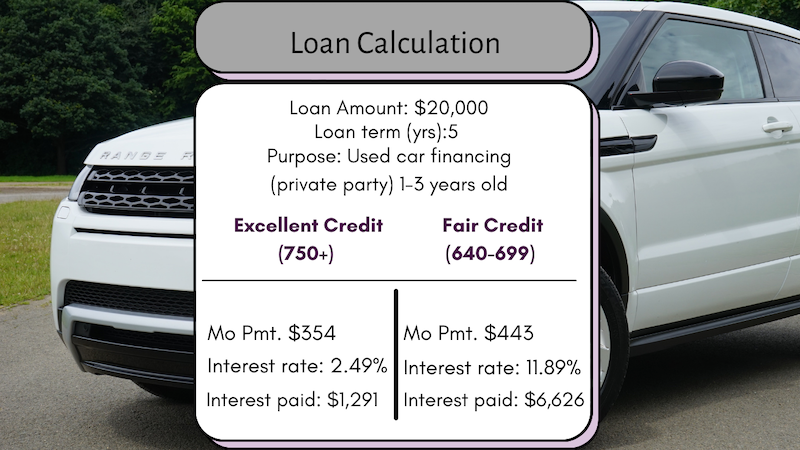

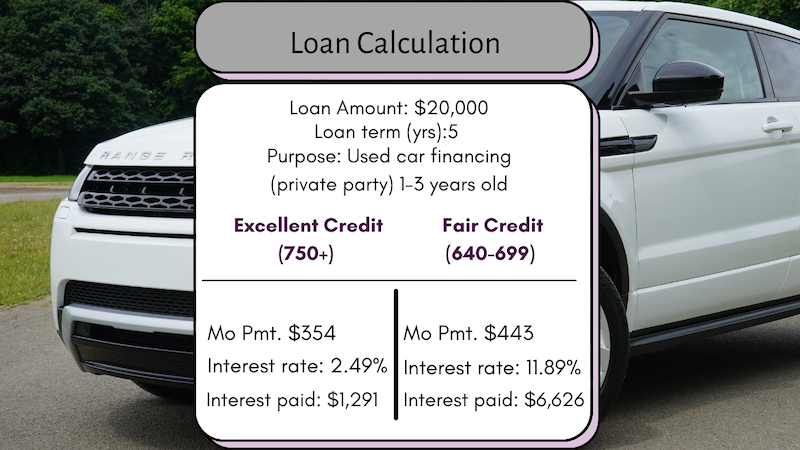

Here is a scenario of someone who has good credit compared to someone with fair credit. The loan amount is $20,000 and we’ll finance it for 5 years. We’ll say the car is between 1 and 3 years old.

What’s the difference?

The monthly payment for the person with excellent credit will pay $354 a month. Compare that to the person with fair credit. That person will pay $443 a month. Check out the difference in the interest rate.

Did you notice how much the person excellent credit will pay the bank for taking a risk on them? They are paying $1,291 in interest to the bank over the 5 year loan. Check out how much the person with fair credit will be paying in interest over 5 years! It’s $6,626. That’s substantial!

How bad credit affects your life

- You will pay more in car insurance! Yes! Not only is your car payment higher, you will have to pay more in insurance. It costs a lot of money when you don’t have excellent credit.

- You may be required to have a co-signer. This is stressful asking others to co-sign for you. Essentially you are asking them to make the payments for you if you cannot.

- You may not be able to rent the apartment you want if you have collections on your account.

- You are may be required to put a deposit down on utilities or cellphones.

When you have excellent credit

- You get the job you want (if they require a credit check)

- Eliminate utilities and cellphone deposits

- Pay the BEST interest rates for insurance premiums on your home, rent car & more!

- Get the best interest rates or loan offers when you want to buy a home, car or large purchase.

- Never need a co-signer

- Start your own business

- Make your money work harder for you by investing it or getting credit card rewards & the BEST opportunities.

How to build excellent credit

There are many different ways to build excellent credit, but the way I like to recommend (probably because I worked at a bank in lending) is to open a credit card with a $500 credit limit.

Then put one purchase on the credit card each month. One example is a gallon of milk. Yes, just ONE purchase.

When you get the statement, you pay it in full and on time each month.

You have to use credit to build credit!

This is how you build credit.

Learn More!

I hope you found this information helpful!

Any recommendations I make should be taken into consideration with your values and goals. You should make the best decision that aligns with your family’s values.

As a Financial Coach, my mission is to help families save more, spend less so they can buy and do the things most important to them and spend their time and energy focusing on their kids.

Spending quality time with your kids is more important than stressing about finances. Instead of going to friends and family and sharing your financial struggles, reach out to me. I love talking about money, values, assessments and strategies to make positive changes to your financial habits to live a life you love.

Stressed About Finances?

I understand because I’ve been through some really challenging financial situations. Learn more about me.

I’m a kind, heart-centered coach who is excited to help you! If you’re struggling with your finances, get the results you want – I promise to keep you accountable and help you manage your finances successfully . I have a 100% guaranteed or your money back for the 1st session!

Finally, I wish you success in your financial journey😊

Join the private Facebook community to get tips, tricks & hacks to save more, spend less & build excellent credit

Follow me on YouTube to get tips, tools and helpful resources to CRUSH your financial goals!

1:1 Coaching:

Get personalized coaching focused on you