As a single mom, you’re always looking for ways to save money while still providing for yourself and your family. One big expense that can be hard to navigate is buying a car. With so many factors to consider, it can be overwhelming to try and figure out what is truly important. When it comes down to it, the most important factor when buying a car is your monthly payment. I’ll explain what factors into the monthly payment, why it’s important to fit into your budget, and what percent of your income you should allocate for it.

“Wealth is not about having a lot of money; It’s about having a lot of options”

What Factors into Your Monthly Payment

Your monthly payment is made up of a few important factors. The first is the price of the car. Obviously, a more expensive car will result in a higher monthly payment. The second factor is the interest rate. If you have a high interest rate, your monthly payment will be higher. Having excellent credit will ensure that you have thee best interest rate. The third factor is the length of your loan term. If you spread your payments out over a longer period of time, your monthly payments will be lower, but you’ll end up paying more in the long run due to interest. It’s important to keep these factors in mind when shopping for a car so you can get an idea of what your monthly payment might be and how it fits into your budget. I like saving and spending plan better!

Why Your Monthly Payment Should Fit into Your Budget:

It might be tempting to stretch your budget a little bit to get the car you really want, but this could end up causing more harm than good. If your monthly payment is too high, it could cause you to have to stretch your budget even further, potentially causing you to miss other important bills or unexpected expenses. It’s important to make sure your monthly payment is realistic and fits into your saving and spending plan so you can still enjoy life while paying for your car. The excitement and newness does wear off.

What Percent of Your Income Should Be Allocated for Your Monthly Payment

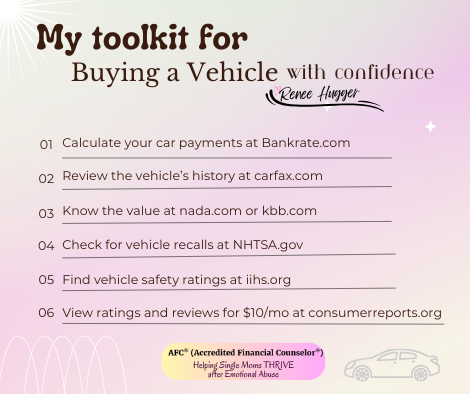

A good rule of thumb is to allocate no more than 10-15% of your income towards your monthly car payment. This ensures that you still have enough money left over for other expenses and savings. It’s important to sit down and do some calculations to figure out what works for your specific budget and lifestyle. I like Bankrate.com to calculate my loans.

- Calculate your car payment at Bankrate.com

- Review the vehicle’s history at Carfax.com

- Know the value at NADA or Kelley Blue Book

- Check for vehicle recalls at NHTSA (National Highway Traffic Safety Administration

- View ratings and reviews at consumer reports

Other Factors to Consider

While your monthly payment is the most important factor when buying a car, there are other factors you should consider as well. For example, you should take into account the car’s gas mileage, maintenance costs, and resale value. It’s important to do your research and make sure you’re getting a car that meets all of your needs, fits into your budget, and will hold its value over time.

One last thing…

When it comes down to it, the most important factor when buying a car is your monthly payment. Make sure you keep in mind all the factors that go into it, why it’s important to fit it into your spending plan, and what percent of your income you should allocate for it. By doing your research and making an informed decision, you can buy the car you need without breaking the bank.

If you share my passion for emotional well-being, pain relief, or tackling common seasonal symptoms, this watch is a must-see.😊

Learn more about the WAVwatch and it’s 1,000+ settings👉 Use the coupon code RENEE100 for $100 off💥 Excited for you!💜