I really want you to understand how to budget. It’s really easy to put numbers on paper, but when you are in the store shopping and really want something, that’s when it gets difficult. Here are six motivational reasons to budget your money. When I first starting budgeting, I failed miserably!!! Specifically, the reason I had failed miserably was because I was making a monthly budget, not a payday budget! This was my “aha” moment! Therefore, I decided to make a budget around my paydays. Specifically, I had two budgets, one on the 1st and another on the 15th.

I was paid twice a month, not monthly! Therefore, I didn’t have a clear plan on what bills would be paid out of each paycheck. Consequently, I would pay most of my bills that were due before the 15th of the month with my first paycheck and the remainder from my second paycheck. Ultimately, this would leave me with no extra spending money from my second paycheck. UGH!

I would go round-n-round (like a puppy chasing its tail!) month after month, trying to figure out how to make my budget work. After feeling frustrated month after month, I got serious about my budget. I sat at the computer and really analyzed when it was wise to pay each bill. Then I determined how much my variable and fixed expenses were. Most important, I needed to stick to my budget.

Benefits of Creating a Budget

When you have a budget,

- You have a deep understanding of your finances.

- You know where your money is spent.

- It alleviates the stress of unexpected expenses because you have an emergency fund.

- They help you spend your money in a wise way so you don’t run out before your next paycheck.

- Having a budget gives you peace of mind and alleviates stress because you are creating flexibility in your personal finances to make bigger purchases in the future.

- When you have flexibility in your budget, this leads to freedom, freedom to make big life choices and have fun with your hard-earned money.

Income

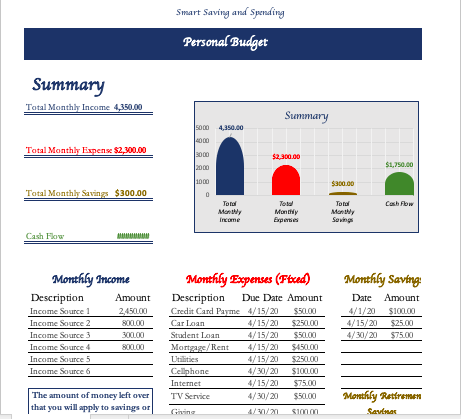

Step 1. The first step is to add up your total monthly income for your household. The amount deposited into your checking account is your net income. To clarify, your net income is calculated by taking your gross monthly income and subtracting all your deductions (dental insurance, health insurance, retirement, social security, Medicare, etc.). Finally, add your income to your budget.

Fixed Monthly Payments

Step 2. Next, you will want to view your account statement by logging onto your checking account so you can view all of your transactions for the past month. That is to say, if you have a printed monthly checking account statement, that works too. Meanwhile, go through all of your recurring payments for the past month and write down the expense and the monthly amount in your budget.

In addition, I took my fixed monthly expenses and separated them into two groups in my payday budget. I would try to get the totals of these two groups to be similar. Below is an example of how I grouped them in my budget:

Payday budget on the 1st of the month

- House payment/Rent – Struggling to make your house payment during COVID-19?

- Disney Plus

Payday budget on the 15th of the month

- Student Loan

- Car payment

- Cellphone payment

- Car insurance

- Internet

- Credit Card – Understand how a credit card works.

- Streaming services

- Utilities

Tip: Some bills may be due before the 15th of the month. You definitely want to avoid any late fees and penalties, so you will want to have those expenses come out of your paycheck on the 1st of the month.

For this example, let’s say the mortgage/rent payment is due on the 8th of the month. It is wise to pay it out of the paycheck on the 1st of the month to avoid any late fees or penalties.

Variable Monthly Payments

Step 3. Next you want to determine your variable monthly expenses and write the amounts down in your budget. If you look back through your expenses from the past month, you should get a pretty good idea of how much you spend on these items.

Remember, this is just a starting point and can be changed as time goes on. Trust me, it gets easier as time goes on because you will be more in tune with your finances.

Examples of variable expenses are:

- Groceries

- Toiletries

- Cleaning supplies

- Clothing

- Fuel

- Oil changes

- Entertainment

Now take the Total variable expenses and divide them by 2. You want to do this because half of these expenses will come out of your paycheck or budget on the 1st of the month and the other half will come out of your paycheck or budget on the 15th of the month.

Savings

Step 4. Next, think about how much money you would like to save each month. It can be for retirement, general savings or for your emergency fund (or all of them) and write down the amount you will save each month. I have listed a few examples below.

- General Savings

- Emergency fund

- Retirement

- Vacation savings

- Christmas savings

After you figure out how much you want to save each month, take the total monthly savings and divide it by two. You will subtract that amount from your paycheck or budget on the 1st of the month and the 15th of the month.

Step 5. Almost done! All we have left is the math. We will take our income on the 1st of the month and subtract ½ of the monthly fixed payments, then subtract ½ of the monthly variable expenses and finally subtract ½ the total monthly savings amount. Then you will get your cash flow (a fancy word for cash left over). Then do the same for the income, expenses and savings for the 15th of the month.

Remember, budgets are supposed to be user friendly. If you end up spending a little more on groceries or less on toiletries, remember these numbers can be changed. They are a guide to keep you on track.

This really does get easier as time goes on. You have completed the hardest part – gathering information and writing the numbers down on paper.

Motivational Tip: When I had cash left over in my budget from my grocery expenses or dining out expense for the month, I would put the extra money towards entertainment. As a result, it was motivational for me to spend less on my grocery or dining out budget. More importantly, I could have some extra fun in life. Hope this helps you!

In short, having a budget gives you peace of mind and alleviates stress because you are creating flexibility in your personal finances to make bigger purchases in the future. Most importantly, when you have flexibility in your budget, this leads to freedom, freedom to make big life choices and have fun with your hard-earned money.

You are going to do great at this! Budgets are supposed to be user friendly. The trick is to find the right amounts in your budget and be intentional on how you spend. These are great guides to keep you on track.

Tip: When I had cash left over from my grocery expense or dining out expense for the month, I would put the extra money in entertainment. That way it was motivational for me to beat my budget so I could have some extra fun in life. Hope this helps you!